Table of Content

- VA funding fee for streamline refinance

- Understanding VA Loan Funding Fees Helps You Compare VA Loans and Conventional Mortgages

- When might you be exempt from paying the va funding fee?

- Who pays for which closing costs?

- VA refinance funding fees

- VA funding fee refinance chart

- How is the VA Funding Fee calculated?

- Financed Upfront Funding Fee

We physically stand in line at the records repository and manually coordinate your order, freeing up your time and easing your worries about whether or not you will get your DD214. Much like paying a small fee to have your taxes done by a professional, DD214Direct provides the service and convenience you’ve been hoping for, plus we make it a lot easier. Veterans eligible to receive VA compensation “as a result of pre-discharge disability examination and rating or on the basis of a pre-discharge review” of existing medical evidence. The VA loan funding fee is reduced for those who pay at least 5% down, and the lowest possible VA loan fee is offered to those who put 10% down. The VA Loan Funding Fee is calculated using a table referencing the borrower’s status as a first-time user, active duty/Guard/Reservist/Retired or Separated status, etc.

If your down payment is small, or non-existent, then it may be best to go with a VA Loan. Just keep in mind that the larger your mortgage, the larger the funding fee. If you are eligible for this exemption, you will need to provide documentation of your VA disability to your waiver. Be sure to speak with your VA Loan lender if you believe you may be eligible to have the VA Loan funding fee waived.

VA funding fee for streamline refinance

Funding fees are based on a percentage of the loan amount, but not all loans require the same percentage. The VA Home Loan is one of the only home loans available today with no down payment required. Service members and veterans who are Purple Heart recipients will also be exempt from the VA Loan funding fee, starting on Jan. 1, 2020.

When you’ve financed your Upfront MIP, you need to multiply this result by 1 plus your Upfront MIP percentage to get your annual MIP. Even with the VA funding fee included, VA loans typically provide a better deal to vets than conventional loans or FHA loans, both of which require down payments. Plus, VA-insured loans offer competitive mortgage rates compared to other loan options. In addition to the Purple Heart recipient rule , the VA has changed other aspects of the VA loan funding fee exemption.

Understanding VA Loan Funding Fees Helps You Compare VA Loans and Conventional Mortgages

VA Loan Guaranty Service employees and representatives of the private industry describe the benefits of the VA Home Loan and why they serve Veterans.

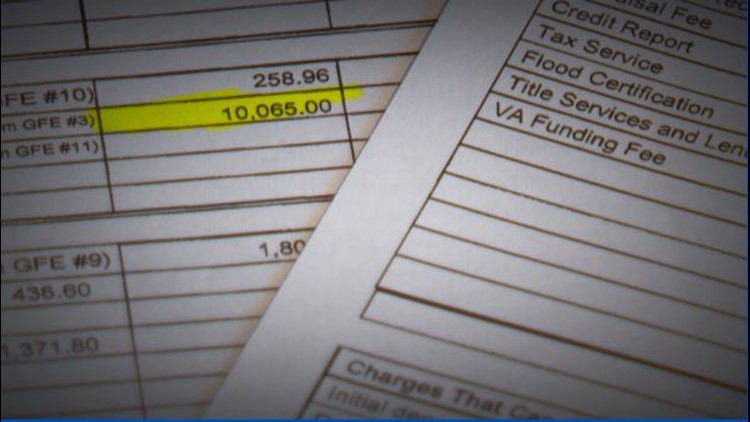

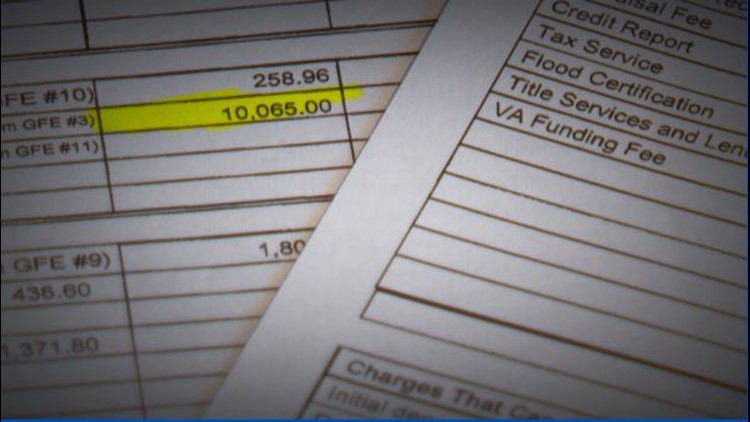

(The VA Funding Fee is the only closing cost that can be rolled into the home loan.) Most VA borrowers choose to finance the fee, even though their monthly payments will be slightly higher as a result. The fee is due at closing and collected by your lender, who then automatically transfers the payment directly to the VA. In some instances, lenders will offer to pay your closing costs or roll them into your loan. Other changes to the VA program include a rule for VA loan funding fee refunds.

When might you be exempt from paying the va funding fee?

The VA cash-out refinance follows purchase requirements at 2.3% or 3.6%, depending on prior use. Typically those required to pay the VA funding fee choose to finance it into the entire loan amount. Your lender is responsible for collecting the funding fee and sending it directly to the VA through their automated system. Mortgage lenders have no control over who must pay the VA funding fee or the specific amount.

The VA funding fee is an upfront expense paid when applying for a VA mortgage. Rather than go to your lender, this cost goes directly to the Department of Veterans Affairs to help fund the program and keep it running. Veterans rated by the VA as eligible to receive compensation as a result of pre-discharge disability examination and rating. The law now permits a waiver based on a pre-discharge review of existing medical evidence , that results in the issuance of a memorandum rating by the VA. This was important for some veterans who deserved a VA loan funding fee waiver, but previously, could not get their waiver in time to close the loan. The funding fee for a Cash-Out refinance is similar to a VA purchase loan, except borrowers cannot lower the VA funding fee by making a down payment or using equity.

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs, and it supports the VA home loan program. Veterans who put down less than 5% on their home purchase will pay 2.3% of the loan amount when buying a home for the first time, and they’ll pay a funding fee of 3.6% on subsequent loans. VA borrowers can pay less on the funding fee by putting down more money on the home. The VA loan funding fee is an administrative fee added to most VA mortgages. The amount varies based on your circumstances; first-time buyers with zero down pay a 2.3% funding fee while repeat VA loan users could pay up to 3.6 percent.

But VA Loans may be subject to a funding fee, which is required by federal law and is something conventional loans don’t have. VA Home Loans are one of the best ways for veterans to purchase or refinance a home. There are also some differences, including the VA Loan Funding Fee, which the VA requires .

If you’re using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, you’ll need to pay the VA funding fee unless you meet certain requirements. Learn about the VA funding fee and other closing costs you may need to pay on your VA-backed or VA direct home loan. You might be able to get a seller to either lower the purchase price or cover a portion of your closing costs. This is more likely if the seller is motivated and the home has been on the market for a long time with few offers.

You can pay your funding fee upfront as part of your closing costs, or you can bundle the expense into your loan amount and finance it over the term of the loan. While the VA requires most borrowers to pay the VA funding fee, not every borrow must. A handful of exemptions exist, including borrowers who receive compensation for service-connected disabilities.

You’ll pay a one-time guarantee fee and an annual fee to the USDA’s Rural Development program. Refinance your current VA loan with minimal out-of-pocket expenses. Fees for a first VA purchase loan are 2.3% with a zero down payment, 1.65% with a down payment of 5% to 9.9%, and 1.4% with a down payment of 10% or more.

The veteran would be entitled to receive compensation for service-connected disabilities if they did not receive retirement pay. A VA funding fee is the upfront expense paid to secure a VA mortgage. VA loans offer affordable alternatives to conventional mortgages for eligible service members, as well as certain family members. Removing the down payment from the equation is a huge incentive for many prospective homebuyers — not to mention the competitive interest rates and absence of private mortgage insurance. If that's the case, expect to pay the VA funding fee at closing.

No comments:

Post a Comment